ServiceDesk.iQ systems for service maintenance of specialized banking and other equipment are usually developed or adapted to a specific model of the service company's operation and remain only one of the IT infrastructure components.

Bank technical maintenance service companies are well aware about the failure costs of specialized equipment (ATMs, payment kiosks, POS terminals and other devices) for their customers and service providers in terms of reputation and materials. For this reason, service companies make every possible effort to optimize and improve the control level supervising the processes of equipment repair, installation and decommissioning.

Bank technical maintenance service companies are well aware about the failure costs of specialized equipment (ATMs, payment kiosks, POS terminals and other devices) for their customers and service providers in terms of reputation and materials. For this reason, service companies make every possible effort to optimize and improve the control level supervising the processes of equipment repair, installation and decommissioning.

Using five fundamental principles of service and effective tools for their implementation, specialized companies can achieve a significant increase in the availability level of devices and reduce the costs associated with operating activities.

1. Taking into account the specifics of SLA compliance

Critical infrastructure’s maintenance contracts always include the time and the standards for all the works performed. Often the customer is not even aware of the nuances of the service company's work, because only the level of equipment availability (ATMs, kiosks, POS-terminals) is important.

The bank’s clients do not expect to wait long for the service, and bankers, implementing their client strategy, are forcing the service provider into a tight framework. It is the greatest importance for the contractor to prioritize the works properly and to warn ASAP the clients about any delays in the repairs and other works performance.

The application of specialized software allows both - the engineer who received the work order and the managers of different levels - to have a clear view on the list of all tasks, prioritize them accordingly in order to ensure minimum equipment usage and avoid penalties stipulated in the service agreement.

2. Comprehensive approach to the cost accounting

2. Comprehensive approach to the cost accounting

The maintenance service of equipment is associated with a variety of direct and hidden costs: salaries of engineers and drivers, transportation costs, ctr. In practice, the service’s economic efficiency depends on the ability to organize the processes of local repair and transportation of spare parts from one warehouse to another.

An integrated approach to track the life cycle of each device or equipment part, as well as all related costs accounting, allows monitoring the performance and objectively assess the weaknesses of the business model of the service provider. To obtain such data, service provider needs to create an effective information environment, in which all the necessary information is promptly displayed.

3. Monitoring the life cycle of the client request

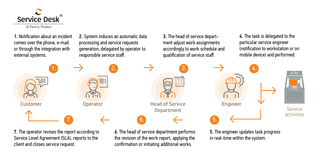

One of the service standards requirements is that the client request along with created tasks cannot remain outside the zone of responsibility of at least one service company employee. This means the guaranteed work performance supervision by the engineer or by senior engineer and thereafter the task is closed or returned to the performer along with notification to the customer.

This allows building the transparent scheme of the client request life cycle, to avoid organizational errors resulting the execution of work within the timeframe, and create the truly client-oriented model for the provision of services. In addition, in case of conflict situations, the management of the service company is able more quickly establish responsible persons.

4. Mobile solutions for engineers and managers

The service engineer’s work includes constant travelling between objects in the zone of his responsibility: the specialist can travel up to 300 kilometers per day. The mobile devices and software solutions are designed to communicate with the management and obtain information on the priority of tasks and able to optimize tasks performance and proper delegation.

In addition, mobile service solutions will be useful for senior engineers or support department managers who may also be away from their office workplace for much of the day. The convenient mobile interface for assigning tasks, tracking progress, and evaluating the performance of subordinates is an important advantage of specialized service management systems.

5. Integration ability with different systems

Service Desk systems for service maintenance of specialized banking and other equipment are usually developed or adapted to a specific model of the service company's operation and remain only one of the IT infrastructure components. The business intelligence systems allowing evaluate the performance of the service provider and analyzing the various complex parameters could be the valuable addition to such solutions. The service management systems can import data from technical monitoring systems. This allows automating and significantly speeding up the request processing and assigning the relevant work.

The ability to integrate such systems determines the level of easy solution’s use and provides an opportunity to achieve greater efficiency without significant investment or changes in already established operational processes.

Service Desk.iQ, developed by BS/2, combines the advantages of modern systems to optimize service. Moreover, the developers took into account the special needs of companies engaged in repair and adjustment of equipment for banks and retailers. Several large service companies in Kazakhstan, Kyrgyzstan, Georgia, Azerbaijan and the Baltic countries are using ServiceDesk.iQ solution. Please contact our sales department for more detailed information about ServiceDesk.iQ.