Despite the significant increase of non-cash payments, trade and service enterprises (TSPs) still remain points of mass cash storage. Merchants turn to remote cash capture to make sure the cash collected from registers isn‘t being held up at cash points and isn‘t delaying the cash flow process.

Despite the significant increase of non-cash payments, trade and service enterprises (TSPs) still remain points of mass cash storage. Merchants turn to remote cash capture to make sure the cash collected from registers isn‘t being held up at cash points and isn‘t delaying the cash flow process.

Despite the significant increase of non-cash payments, trade and service enterprises (TSPs) still remain points of mass cash storage. Merchants turn to remote cash capture to make sure the cash collected from registers isn‘t being held up at cash points and isn‘t delaying the cash flow process.

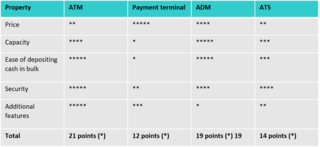

In one of our recent articles, we discussed which automated devices are suitable for remote cash capture, comparing automated deposit machines (ADMs) with automated teller safes (ATS). This time we decided to compare ADMs with much more competitive rivals - ATMs.

Choosing between both of these devices solely for depositing cash and instantly crediting funds to an account is quite a difficult task for a bank. ADMs can be attractive for financial institutions because they are inexpensive, easy to maintain and can store plenty of cash. However, first things first.

Capacity

One of the main advantages of automated deposit machines is their high capacity. Some models provide the ability to store up to 30 thousand notes - these are record holders of the market in terms of capacity, although at the same time the most popular models on the market have a capacity of only 6-8 thousand notes. Currently there is about 100 different models of ADMs on the market, but only about a dozen have a capacity of more than 15 thousand banknotes. These are the AMDs worth comparing with ATMs, which can hold up to 12 thousand notes on average.

A regular multifunctional five-cassette ATM (not to mention eight-cassettes) is capable of competing with the majority of ADMs on the market in terms of capacity. However, it is best to compare ATM recyclers, since standard Cash-In ATMs, which work exclusively for cash reception, are a rarity - most Cash-In/Cash-out ATMs do not use all of their cassettes exclusively for cash-in operations.

Reliability

In terms of availability, unfortunately, deposit machines are far behind ATMs, which have proven to be a reliable solution in any weather. ADMs are a relatively new concept, and manufacturers pay much less attention to the protective and operational characteristics of ADMs than they do to those of ATMs. Manufacturers of most ADM models can only dream of availability rates of 95-98% of Diebold Nixdorf ATMs (subject to professional service). This figure is even worse if the manufacturer, wanting to offer the customer a low price, saves on terminal case costs, neglects the protective characteristics of safes or uses low-quality components. For example, installs a cheap bill acceptor which accepts fakes, and breaks down on virtually every thousandth banknote.

The choice of a reliable manufacturer, supplier and professional service team conducting regular scheduled maintenance of self-service devices is able to raise ADM fault tolerance to 80-90%, however, ATMs in this aspect remain out of reach.

Ease of use

It is just as possible to deposit large amounts of cash with the help of ATMs-recyclers as with ADMs, however some ADM models accept large bundles of money (bulk deposit), which, undoubtedly, is much more convenient than depositing note-by-note. Both ATMs and ADMs can be equipped with custom touch screens that greatly simplify the process.

An important difference in terms of ease of use: it is easier to implement various methods of user authorization on ADMs, since transactions, as a rule, bypass the processing center and are routed directly to the bank’s ABS.

Automated deposit machines are also easier to maintain than multifunctional ATMs, which is a big benefit for service employees and CIT personnel.

Additional services

ATMs remain leaders in terms of additional functionality among all types of banking self-service devices. In recent years, the trend towards expanding the standard functionality of ATM is gaining even more momentum due to the introduction of additional functions such as receiving payments, currency exchange, money transfers, and cardless transactions.

Monofunctional devices don’t stand a chance when competing in this sense with ATMs, luckily such a task is not even necessary for automated deposit machines. As a rule, ADMs are used for very specific cases and are often located exclusively on the territory of trade and service enterprises, where there is no need for ATMs.

Price and ROI

ADMs are cheaper than ATMs - and this is the main reasons why credit organizations choose to purchase them. In terms of capacity-to-price ratios, ADMs leave ATMs far behind, which makes ADM especially attractive for small banks in countries with large cash flows.

At the same time, the existing servicing infrastructure is a big benefit in favor of ATMs and includes everything needed for carefree deployment and maintenance: a processing center, a service department, a warehouse of spare parts and a service department. Since ADMs are relatively new, deploying them carries certain risks and will be accompanied by additional costs in the initial stages.

Conclusion

Conclusion

Both ATMs and ADMs have their indisputable advantages. ATMs are multifunctional, reliable and have tremendous operating experience. ADMs are cheaper than ATMs, they have higher capacity and are easier to maintain.

In addition, deposit machines have certain advantages over ATMs in a number of specific cases. Firstly, they help retailers cope with the business tasks of managing cash circulation. Secondly, they allow optimizing customer service processes within bank branches.

Ultimately, the choice between ADMs and ATMs should be determined by the objectives of the organization and the strategy for managing the fleet of self-service devices.

As an all-in-one, easy to implement solution for remote cash capture, BS/2 offers Cash-in Box.iQ - a large capacity deposit machine with specialized software ready for integration with virtually any bank systems.